nso stock option tax calculator

Content updated daily for stock options tax calculator. Nonqualified stock options receive less favorable tax treatment vs.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Enter the number of shares purchased.

. Calculate the costs to exercise your stock options - including taxes. You exercise your options and hold at least one year before selling You exercise your options and sell in under one year. What are Non-Qualified Stock Options NSOs.

January 29 2022 On this page is a non-qualified stock option or NSO calculator. This would result in a tax bill of 3750 instead of 8000. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price.

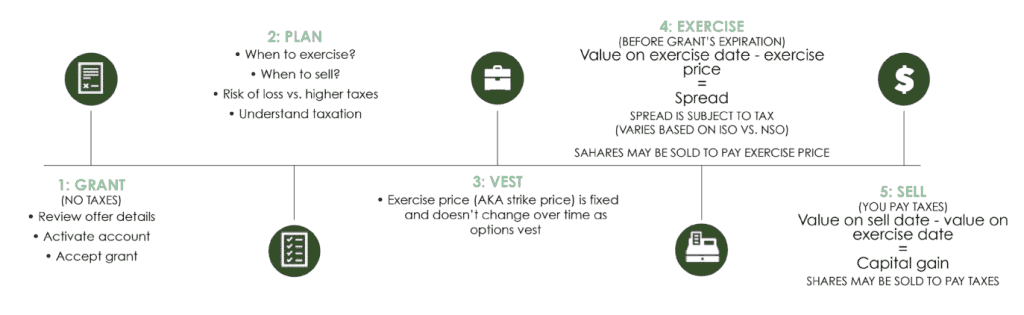

A non-qualified stock option NSO is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option. These are called non-qualified as unlike ISOs NSOs do not meet all the requirements. So you now pay the IRS the greater of your regular tax or the AMT.

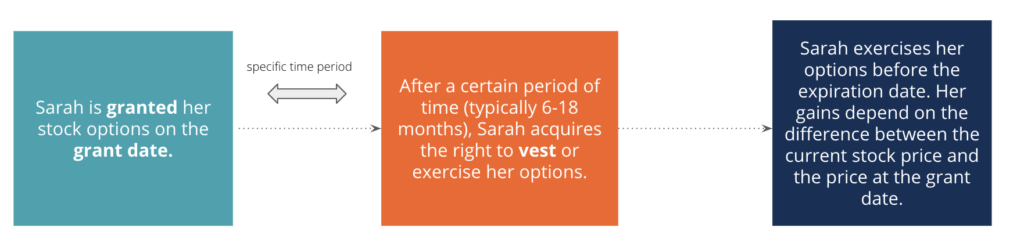

Of Shares Exercised Market Value at Exercise Grant Price In Sarahs case let us assume that shes been granted 1000 shares with a grant price of 5 each. A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders. If either is exercised early the holders of these stocks have to pay capitál gains tax whether or not they received cash or just exercised the option.

On this page is a non-qualified stock option or NSO calculator. The Stock Option Plan specifies the employees or class of employees eligible to receive options. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

The total taxable amount is equal to 40000 1000 x 45 5. Stock Option Tax Calculator. Using this option employers benefit from tax deductions but employees end up paying higher taxes.

Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you exercised the option and purchased the stock times the number of shares you purchased. You exercise your options and hold at least one year before selling You exercise your options and sell in under one year Non-qualified Stock Option Calculator. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs.

50 25 1000 15. Both of them give the recipients the right to buy stocks for predetermined rates in the future but they have varying restrictions and tax consequences for the grant provider and the recipient. Since the spread on an NSO is treated as ordinary income when you exercise it makes a lot of sense to sell immediately to ensure that youll have the funds you need to pay the taxes.

Both an ISO and an NSO are restricted stock. Your payroll taxes on gains from exercising your NQ stock options will be 145 for Medicare only if and when your earned income exceeds the wage base for the given tax year. The stock options were granted pursuant to an official employer Stock Option Plan.

Stock Option Exit Calculator. But given the tax savings waiting another six months before selling should at least be considered. 45 25 20 x 100.

Knowing when and how theyre taxed can help maximize their benefit. A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike priceNSOs do not require employment and the expiration date can be extended well over 90 days although they do not come with the same favorable tax benefits as ISOs. It requires data such as strike price amount and duration of the option and guesstimates the applicable tax rates.

Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use. Marginal Tax Rate Short Term Capital Gains Tax Rate Long Term Capital Gains Tax Rate Compute NSO Return and Tax Compute Show Breakdown. The calculator is very useful in evaluating the tax implications of a NSO.

Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock. See what your stock options could be worth. However you have 30 days from the date the options are granted to make an IRC 83 b election.

How much are your stock options worth. Non-Qualified Stock Option Calculator This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock options. Grant Price FMV at Exercise Include Social Security Tax GENERATE REPORT.

Then calculate the AMT by multiplying by 26 the income amount up to 175000 plus 28 of the amount over 175000. You wont pay more than 62 of your wage base in taxes for Social Security if. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again.

Taxable Amount No. An NSO gives recipients the choice to purchase a companys stock at a predetermined price which can be. Decide whether to exercise your stock options now or later.

Options Strike Price Exercise FMV or Assessment409A Sale Price Tax Bracket Information. Which means youd be taxed at 15 instead of 32. The Stock Option Plan specifies the total number of shares in the option pool.

When companies give options it could either be an incentive stock option ISO or a non qualified stock option NSO. This permalink creates a unique url for this online calculator with your saved information. Of course the stock price could fall back to earth in the next six months.

Exercise incentive stock options without paying the alternative minimum tax. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. The Stock Option Plan was approved by the stockholders of the grantor within 12 months.

Non-Qualified Stock Option Calculator. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and the current. If you earn shares through vesting by remaining.

Less 45000 AMT standard exemption The sum of the above items equates to your AMT taxable income. She exercises the options one year later and sells her shares immediately at the market price of 45.

When Should You Exercise Your Nonqualified Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

Non Qualified Stock Options Nsos

How Stock Options Are Taxed Carta

Non Qualified Stock Options Explained Plus What They Mean For Your Company S Taxes Warren Averett Cpas Advisors

When Should You Exercise Your Nonqualified Stock Options

How Much Are My Options Worth Eso Fund

Tax Planning For Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Stock Options 101 When And How To Exercise And Sell Part 1 Of 2

How Stock Options Are Taxed Carta

Should I Take An Nso Extension

Non Qualified Stock Option Nso Overview How It Works Taxation

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw